The Focus Portfolio is switching channels from News Corp (NWS) -2.5% to Nine Entertainment (NEC) +2.5%.

Both NWS and NEC are media stocks, and we think this is a like-for-like switch in terms of portfolio characteristics, but we have a preference for NEC at its current price and current fundamentals.

We prefer NEC as:

- Its fundamental metrics appear more favourable relative to NWS

- NEC has a higher quality earnings base (excluding real estate)

- NEC is less cyclical and more resilient than the market is implying

- Domain (DHG) (owned by NEC) looks to be at a better valuation point than REA Group (REA) (owned by NWS)

- NEC has a proven history of organic growth

- NEC has higher expected returns to shareholders

- NEC has valuation appeal

Superior Fundamentals

NEC looks better positioned in terms of fundamentals versus NWS. NEC has:

- A lower earnings multiple (significantly lower PE multiple)

- Superior margins

- A higher dividend yield (with franking)

- Superior ROE and ROIC %

| NEC | NWS | |

| EBITDA Margin | 24.6% | 16.2% |

| Net Income Margin | 11.7% | 5.1% |

| EV/EBITDA | 6.5 | 7.2 |

| PE | 10.9 | 19.2 |

| EPS Growth (5 Year CAGR) | 3.3% | -0.3% |

| Dividend Yield | 6.6% | 1.2% |

| Gross Dividend Yield | 9.5% | 1.2% |

| ROE % | 20.2% | 5.2% |

| ROIC % | 17.4% | 9.1% |

Note: FY23E data except for EPS growth (FY22-FY27).

Source: Refinitiv, Wilsons.

A Well-Priced Quality Cyclical

We characterise NEC as a quality cyclical. A quality cyclical usually has an embedded structural growth story that should drive superior earnings growth in the medium-term. As these stocks are more sensitive to economic conditions, growth may be hindered by a downturn in the cycle. However, the structural growth drivers should outweigh the cyclicality over the medium to long-term.

For NEC, the structural story is a shift to digital assets and a larger subscription base, that we believe should outweigh the cyclicality of the advertising cycle.

NEC's subscription business was 32% of revenue in FY22 (up from 20% in FY21). Subscription revenue has grown 28% YoY, and we think this growth will continue (albeit at a slower pace), offsetting the loss in ad spend in a more turbulent FY23.

The current market turbulence may represent a good opportunity to buy a quality cyclical in Nine at a reasonable price after it has experienced a challenging period in the broader sell-off.

Higher quality asset base

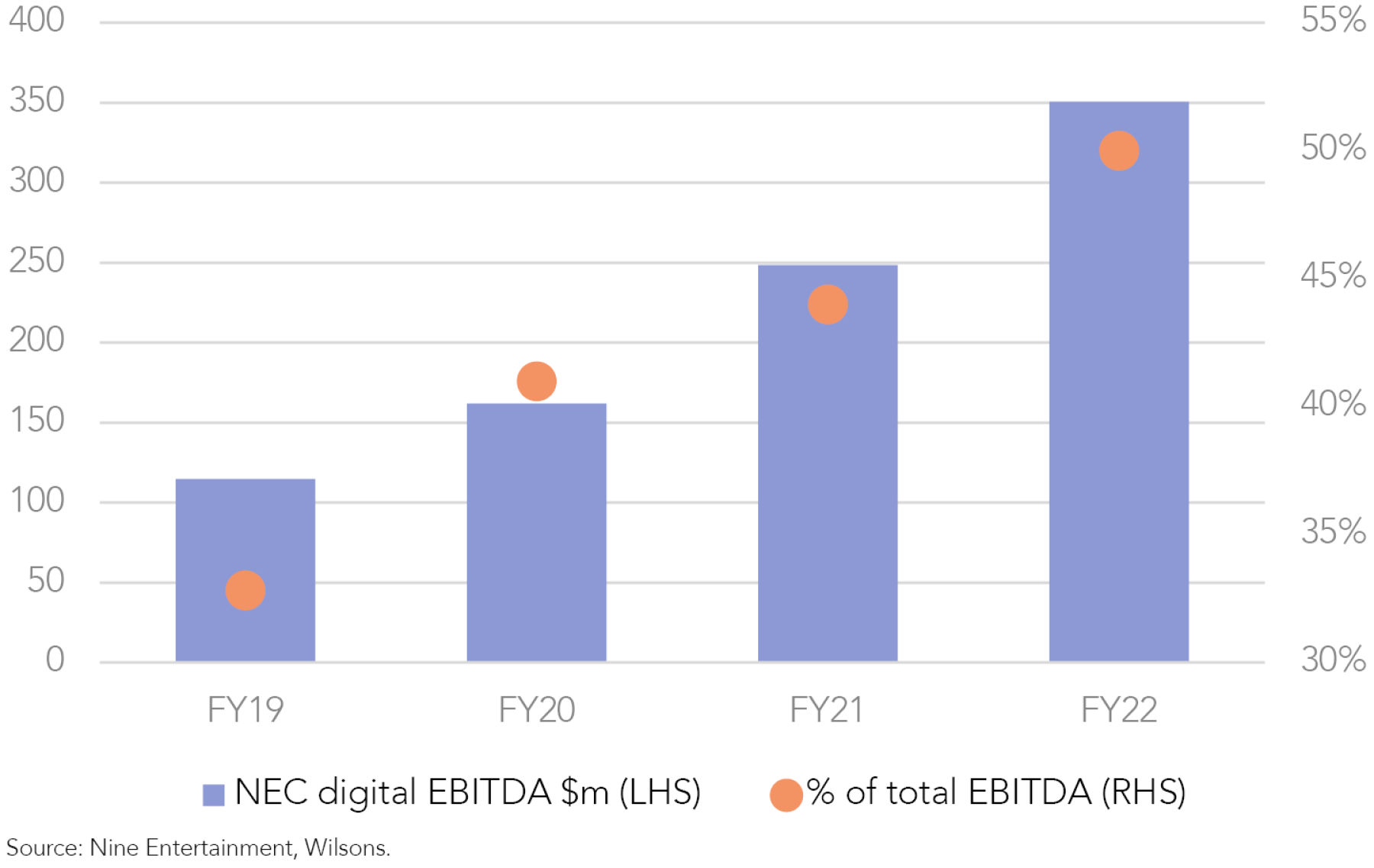

While NWS is also leveraged to digitalisation, we think the story is currently more compelling in NEC than in NWS. Nine has grown its digital assets at a fast pace over the last few years, and we think this trend will continue.

NEC also has less exposure to legacy assets in structural decline like book publishing and cable TV (i.e., Foxtel).

More digital = margin expansion and less cyclicality

The digital proportion of Nine’s underlying revenues has grown strongly in recent years. This has also supported margin growth, as these digital revenues tend to generate higher margins than print or broadcasting assets.

There is still a large runway for digital growth in Nine’s media business, which should be driven by its streaming services (STAN and, importantly, high-margin STAN Sport) and On Demand (i.e. 9NOW).

While News Corp is moving to a streaming service in the forms of Kayo (Sport) and Binge, it is doing this while transitioning away from the cable TV business. Nine does not have this distraction.

The higher degree of digital transformation should offset volatility in ad markets. We believe digital and recurring, subscription-based revenues are stickier and less cyclical than traditional print and TV ad revenues, therefore underpinning a higher degree of earnings visibility. We think this is underappreciated by the market.

We believe higher earnings visibility and higher margins should lead to a rerate in the stock valuation from 11x.

Although the market is currently estimating flat earnings growth for Nine and News Corp over the next few years, we think the risk is to the upside on earnings as the market underestimates the speed and impact of the digital shift.

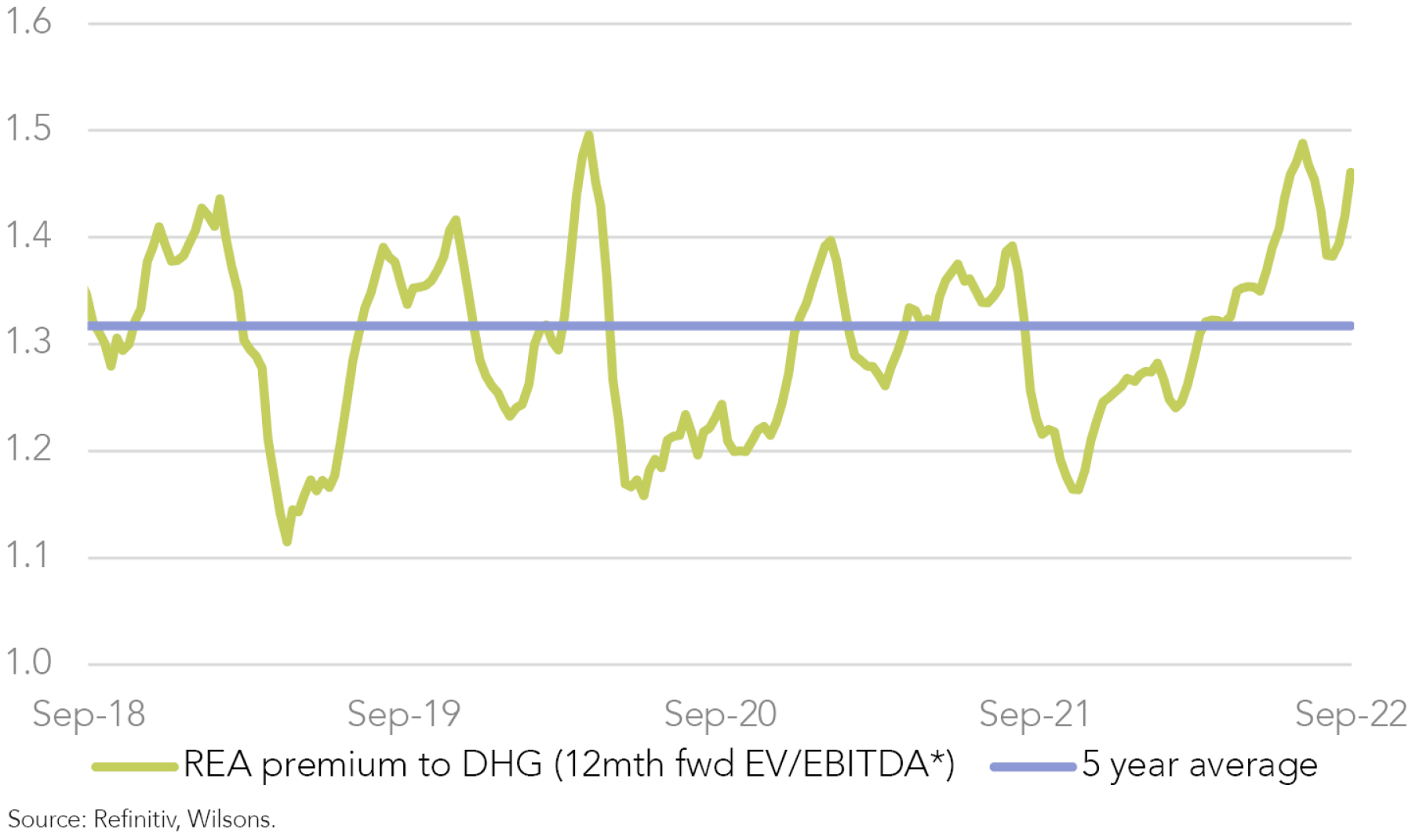

REA/DHG Premium Gap Hard To Justify

Both Nine and News Corp own 59% and 61% of Domain (DHG) and REA respectively.

REA currently sits on a premium to DHG. We believe REA deserves this premium, but the extent of the premium now looks too high relative to fundamentals. It can be argued that REA has a larger market share and higher margins, and therefore deserves a premium. However, the premium has increased significantly since the beginning of this calendar year.

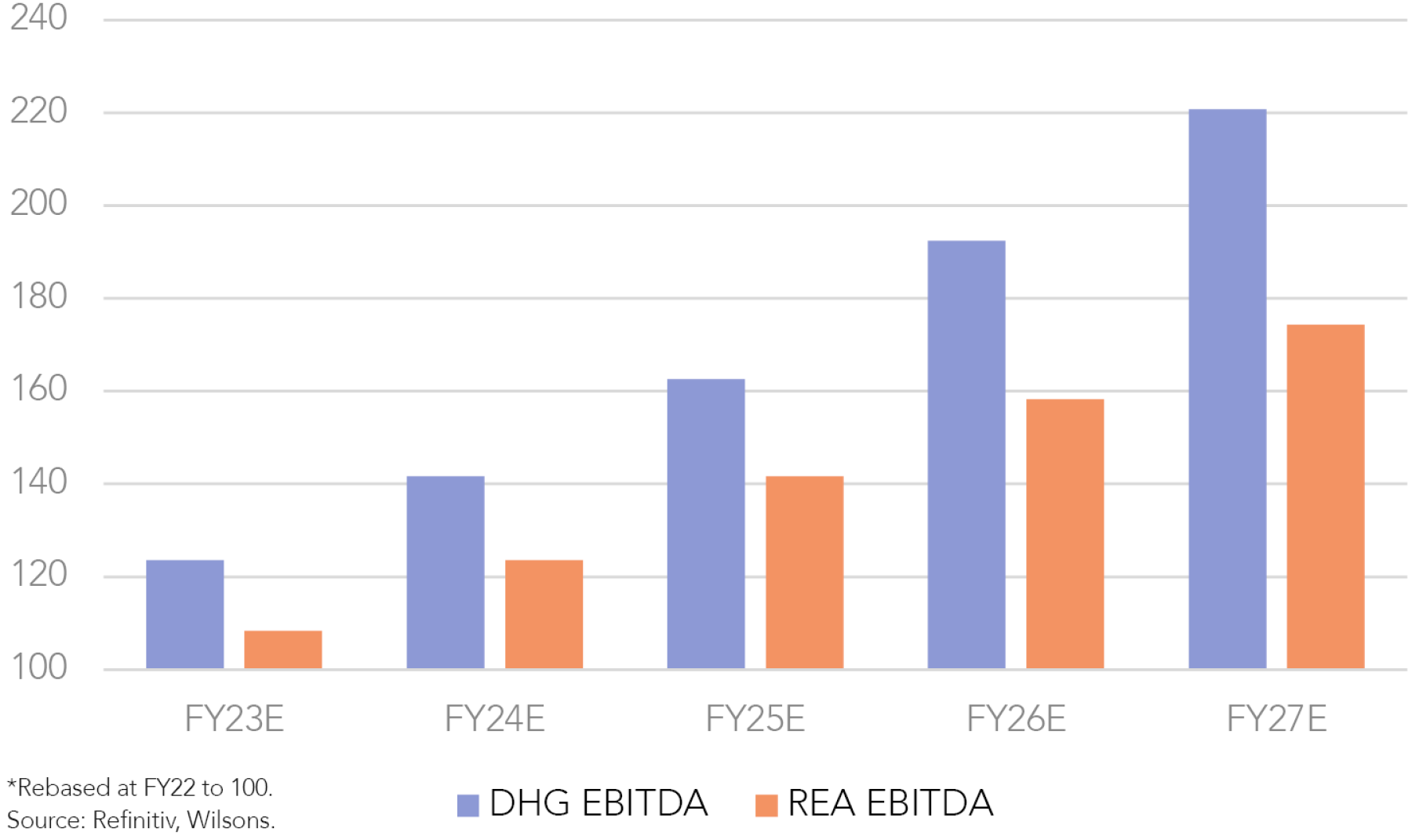

We think this premium is too high. DHG has a stronger earnings growth profile than REA. We would prefer to be leveraged to the stock with the larger growth opportunity and significantly lower multiple. Therefore we have a preference for NEC, as it has exposure to DHG rather than NWS with exposure to REA.

NEC Has a History of Organic Growth

Nine organically created Stan and Domain (as Fairfax) and didn’t need to acquire businesses (at a potential premium) like NWS to grow its earnings.

NEC has a high ROE and ROIC relative to NWS. This indicates that NEC should have a superior ability to grow with less capital, making it easier to grow earning over the medium term. The ability for NEC to grow organically at a lower capital spend is also key to our preference for NEC over NWS.

Higher Capital Returns to Shareholders

NEC also has a recently announced intention to buyback 10% of its share capital. We think this reflects NEC’s confidence in its medium-term outlook, which will eclipse the current, smaller NWS buyback (~8%) that is now ~30% complete.

NEC Has Hidden Value

We have always held NWS for its hidden value, and NEC has this as well. Both the media and publishing assets of NEC look cheap (relative to global peers) once you strip out the market value of the real estate assets.

We believe the market currently underappreciates the intrinsic value of Nine’s core assets. Considering DHG trades on an FY23 EV/EBITDA of ~14.8x and the overall group trades at ~6.5x, the implied multiple of its remaining media segments is ~5.2x.

However, our divisional analysis suggests these assets should trade on multiples of 6.5-7.5x when compared to global peers. This would imply an upside of 35-50%.

While NWS also has potential upside due to hidden value, once we strip out REA, we believe this alone will not lead to outperformance. In our view, nine has more drivers of outperformance via a lower PE multiple, dividends and its superior digital transformation.

| EV (market valuation) | FY23 EV/EBITDA (market valuation) | EV (implied valuation) | FY23 EV/EBITDA (implied valuation) | |

| Domain (DHG) 60% stake | 1344 | 14.8x | 1344 | 14.8x |

| Remaining media assets | 3158 | 5.8x | ~3530-4080 | 6.5-7.5x |

| Combined group | 4502 | 6.5 | ~4880-5420 | 7.6-8.5 |

| Implied Share Price (12mth forward) | ~$2.80-3.10 | |||

| Current Share Price | $2.14 | |||

| Implied upside potential | ~30%-45% |

*in millions AUD.

Source: Refinitiv, Wilsons

Valuation Attractive Versus History

Nine looks cheap relative to history on a PE multiple. We also believe as the stock becomes more digital and more subscription-based, the stock could rerate to a higher multiple. NWS is already at a multiple of 18x: therefore, we think there is less room for a rerate.

Portfolio Outcomes

NEC adds a quality cyclical to the Focus Portfolio, at a lower multiple and a higher dividend yield than the portfolio. While earnings are expected to be lower in NEC, we think the risk is to the upside while NEC transitions to digital and subscription-based revenue.

| Portfolio | NEC | Wilsons Comment | |

| Dividend Yield % | 3.7% | 6.6% | Nine will add more yield to the portfolio |

| Forward PE Ratio (NTM) | 14.9 | 10.9 | Nine is cheaper than the portfolio aggregate multiple |

| LT Future Growth Rate | 9.8% | 3.3% | Nine offers less earnings growth relative to the portfolio, but we believe the risk is to the upside for this growth |

| Beta | 1.04 | 1.52 | Nine is a higher beta stock, but we think this will fall as the company transitions to digital/subscription-based |

| Price to Book | 1.9 | 1.9 | Similar Price to Book as the portfolio |

Source: Refinitiv, Wilsons.

Written by

Rob Crookston, Equity Strategist

Rob is an experienced research analyst with a background in both equity strategy and macroeconomics. He has a strong knowledge of equity strategy, asset allocation, and financial and econometric modelling.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.