Reporting season has generally seen results that have beaten expectations. Overall, FY22 earnings have demonstrated the resilience of corporate Australia as margin pressures intensified into June.

However, there remains a high level of uncertainty for FY23 as margin pressures continue to build. We still believe earnings growth could soften further over the next 6 months.

FY22 results get a pass mark

Reporting season has generally seen positive results. Over the ASX 200, ~61% of companies beat consensus earnings estimates. The most successful sector was Information Technology, with 80% of companies beating estimates, followed by Real Estate and Financials with 72% and 65%, respectively. The median EPS surprise across the ASX 200 was 1.0% (average 1.6%).

| Number of stocks that beat FY22 consensus as a % of total | Number of stocks that upgraded 12 mth fwd earnings as a % of total* | |

| Information Technology | 80% | 60% |

| Real Estate | 72% | 36% |

| Financials | 65% | 44% |

| Communication Services | 63% | 38% |

| Materials | 61% | 17% |

| Consumer Discretionary | 60% | 29% |

| Health Care | 57% | 14% |

| Consumer Staples | 50% | 25% |

| Energy | 50% | 50% |

| Industrials | 50% | 42% |

| Utilities | 0% | 0% |

| Total | 61% | 33% |

*over the last 30 days.

Source: Refinitiv, Wilsons.

Collectively, these results have been above average and deserve a pass mark.

Market positioning key to sector performance

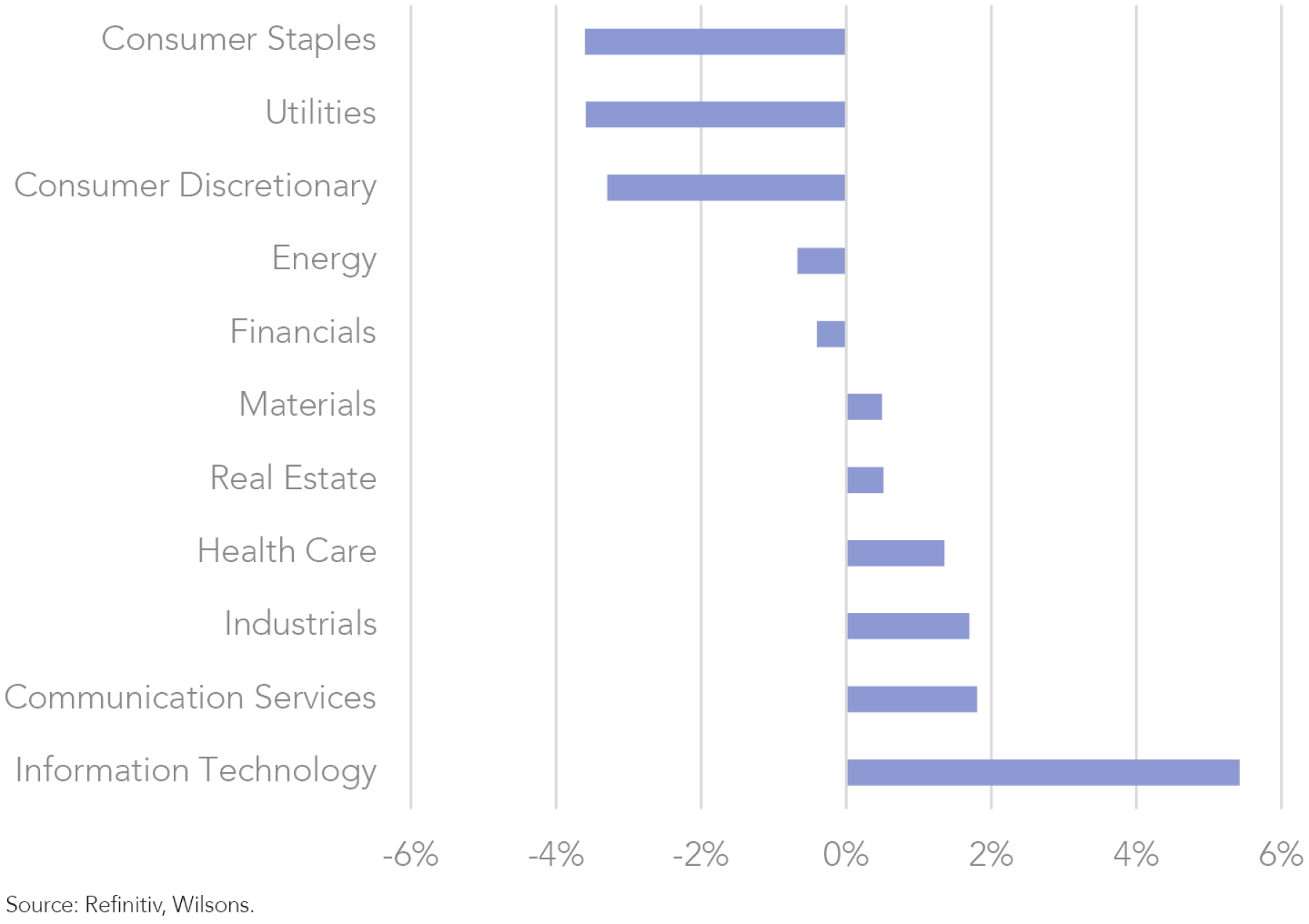

Sectors where sentiment was overly bearish before reporting season outperformed others in the wake of their results.

Tech companies have reacted most positively to their results, given low earnings expectations and bearish investor positioning heading into reporting season. Wisetech (WTC) is a prime example of this. High valuation stock, but a strong result seemingly reminded the market of the structural growth story.

The weakest share price reactions have been in Consumer Staples and Utilities. This reflects the poor performance of these sectors relative to expectations, and the relatively defensive investor positioning heading into reporting season.

The price reaction for consumer staples was worse than the FY23 downgrades, but these companies did not provide the defensive characteristics the market expected.

Positive results, guidance underwhelmed (or non-existent)

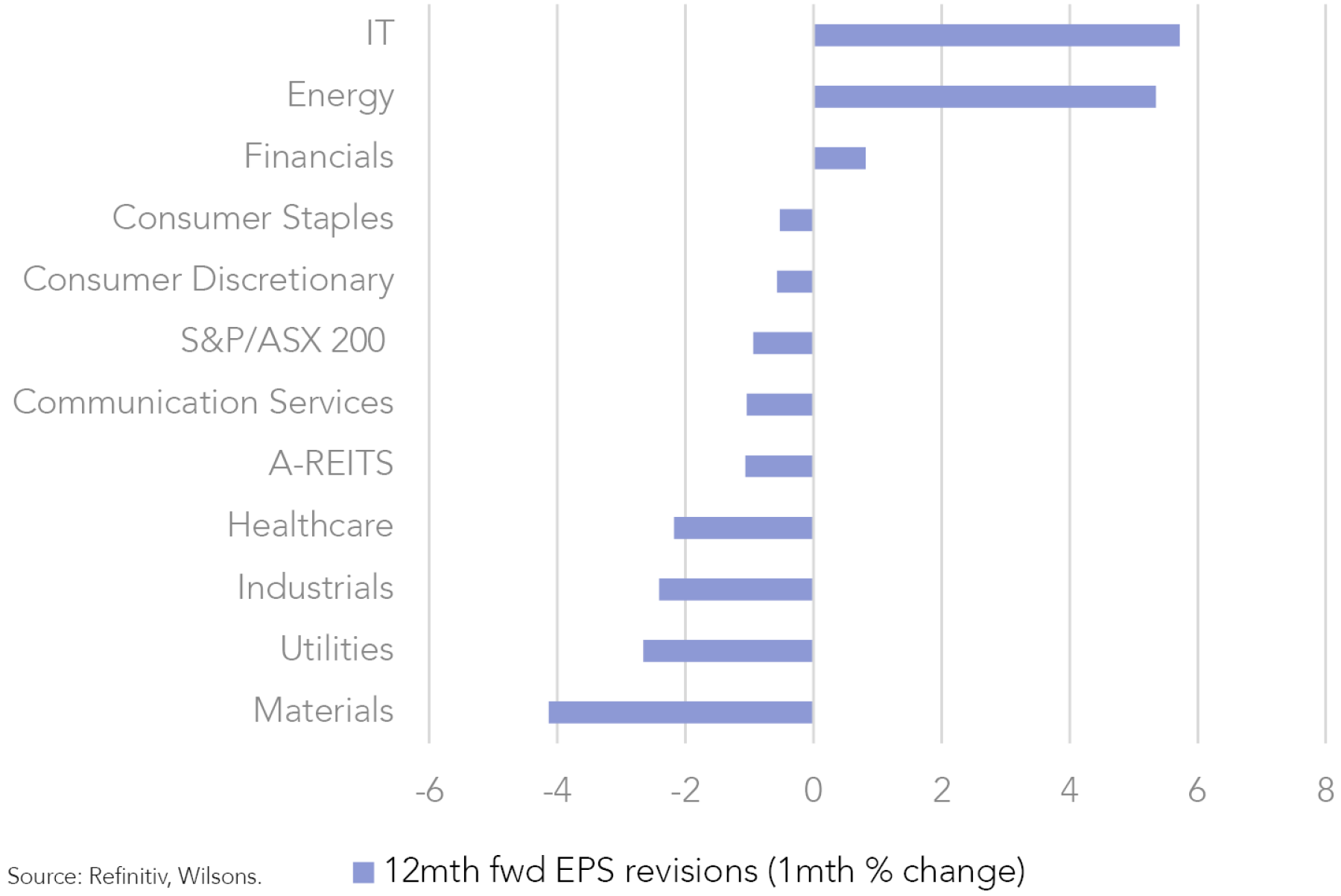

The rosy FY22 picture did not deter the market from downgrading forward earnings. Companies may have beaten expectations in FY22, but with an uncertain 12 months ahead, management teams did not inspire the market enough to stave off FY23 pessimism.

Management's guidance was sparse and, when provided, contained several caveats that probably didn't encourage investor confidence. In light of the uncertain outlook, this was understandable, but it did not help generate any momentum for earnings upgrades.

Over the reporting season, ASX 200 12-month forward revenues have actually been upgraded after previously being downgraded in June and July. However, margins – through higher expected costs – have been the main culprit in earnings downgrades.

EPS downgrades have been relatively broad-based. In the past 30 days, roughly 2/3 of companies have seen their consensus FY23 EPS revised downward. The market is now expecting FY23 earnings to grow 6.5% after growing 20.5% in FY22. This seems too high with ongoing cost pressures and potential for softer demand in FY23.

Margins have held up under pressure

Reporting season has shown that Australian companies have largely been able to keep margins inline or slightly above expectations.

For example, Cleanaway (CWY) admitted FY22 had come with its operational challenges, with labour availability, rising fuel costs and pandemic leave cited by management. However, these cost increases will be offset in FY23 via contractual mechanisms.

Logistics giant Brambles (BXB) increased prices by 17% in H2FY22 after strong increases in timber costs for its pallets, which customers paid, leading to an earnings beat in its FY22 results.

Although input costs have increased, reporting season proved many companies have been able to pass these costs on to their customers.

While the demand outlook likely softens, we believe many companies will have to balance passing on higher costs while maintaining volumes.

We believe the current dynamic of passing costs onto consumers cannot last forever, and companies (unless they have a significant competitive advantage) may have to change tact before the end of this calendar year.

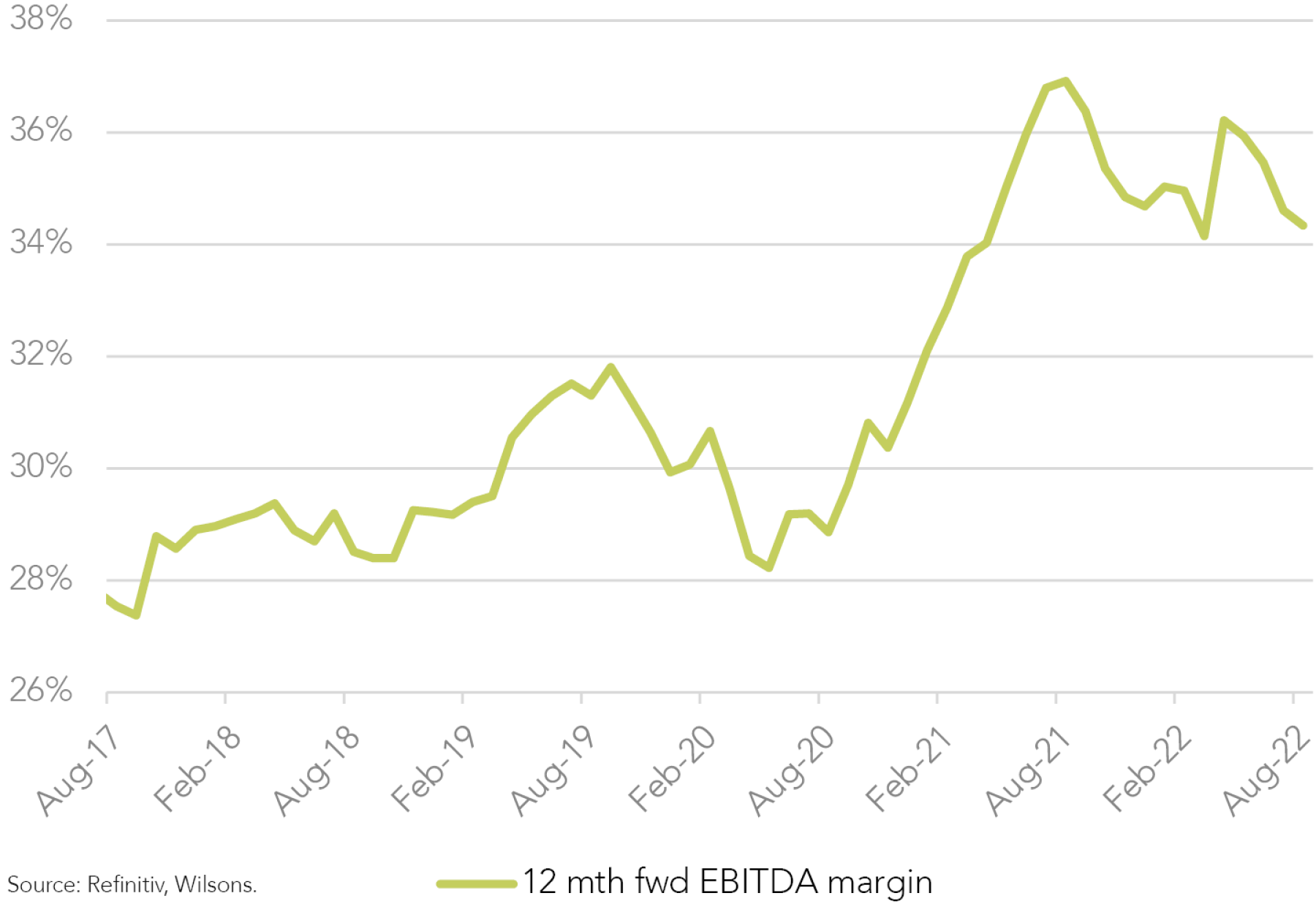

This could lead to margin pressure for many sectors in the ASX 200. Analysts tend to agree with our view, with the 12-month forward ASX 200 EBITDA margin continuing to fall since April, and still falling through reporting season.

Labour a Key Risk for FY23

As a result of labour shortages, many companies are finding it challenging to meet the demand or provide the appropriate level of service. Increasing employee wages to attract talent, is a key risk to margins over the next 12 months.

Wage pressures intensifying

Labour and supply chain costs were a key issue for supermarkets. Coles (COL), Woolworths (WOW) and Endeavour (EDV) underwhelmed on 2H22 margins. COL’s and EDV costs relative to sales increased over 2H22, indicating that these companies could not pass on costs efficiently as the market expected. COL's outlook implied that margins are likely to come under further pressure as inflationary pressures (including wages) remain. Management implied that the costs/sales ratio is likely to increase over the next financial year.

The banks also discussed higher wages. CBA's costs increased 8% half on half as a result of higher wages. In its 3Q22 update, NAB also increased its cost guidance for FY22 (September year-end). In the second half of this calendar year, the big 4 banks may face more cost headwinds, underpinned by labour issues.

Our expectation is that any potential cost increases over the next 6 months will be offset by net margin interest (NIM) growth. Overall, the market has continued to upgrade the big 4 banks' earnings in August.

Staff and skill shortages

Australia has the second most severe labour shortage in the world, behind only Canada, according to the OECD. According to recent ABS data, there were as many job vacancies as unemployed people in Australia.

During reporting season, many companies discussed hiring issues. The shortage of labour has resulted in some companies being unable to meet current demands or provide customers with the level of service they expect.

Qantas (QAN) cited labour shortages as a key problem for providing an adequate service over the last half. After a period of poor service, QAN paid $160m to thank its members for rewarding their loyalty.

Labour shortages could lead to further cost pressures as companies increase wages to retain staff, while also potentially offering sign-on bonuses to hire staff.

We believe labour costs are a key risk for a broad range of sectors on the ASX including resources, tech, supermarkets and banks.

Increasing migration may alleviate these hiring challenges. In August, there were approximately 571k applications for temporary visas awaiting processing, 150k applications for skilled visas and 232k applications for family visas. Over the next 6-12 months, this number of migrants is likely to relieve some labour challenges. However, the process is not expected to be quick.

Quality Companies More Adept at Passing on Costs

We currently believe quality is the best place for equity portfolios, within a backdrop of a slowing growth, margin compression and heightened uncertainty. Quality companies that have the ability to pass on costs should be well placed as broader margin compression plays out.

Over the next year, we expect global economic growth and earnings growth to slow significantly. As a result, companies with high quality, resilient earnings streams should be increasingly sought-after by the market and this should lead to outperformance.

We consider Focus List companies such as Cleanaway (CWY), Telstra (TLS), Lotteries Corp (TLC), CSL (CSL), Resmed (RMD) and James Hardie (JHX) as being able to withstand cost headwinds, with significant pricing power.

The reporting season has given an indication that supermarkets and consumer staples are struggling to withstand margin pressure. CWY, TLS and TLC are our preferred staples substitutes that still have underlying defensive characteristics.

Capital Returns

Buybacks back on the agenda

Quite a few companies have taken an opportunity in price weakness to buy back shares. We have seen this across a broad range of sectors including:

- Airlines – Qantas $400m

- Energy – Santos (STO) +100m on top of a preannounced $250m

- Whitehaven (WHC) announced $1bn shareholder returns by the end of the year (including the $550m already announced in February)

- Media – Nine Entertainment (NEC) announced a plan to buy back up to 10% of NEC stock.

- Gold Miners – Northern Star (NST) announced a $300m buyback

- Consumer staples – a2 Milk (A2M) announced a NZ$150m buyback

Positive Dividend Surprises but Payout Ratios Look To Have Peaked

The major ASX large caps have generally surprised on the upside when it comes to their dividend payouts this reporting season. From the top 10 companies (in market cap) that reported, shareholders received around $50bn in returns via dividends.

The biggest positive surprises came from CSL, Woodside Energy (WDS) and Wesfarmers (WES), which beat expectations by 7.2%, 6.9% and 6.3% respectively. WDS’s interim DPS was its largest in 8 years reflecting strong cash generation from buoyant oil and LNG prices.

BHP was also a standout as it returned ~A$24 billion to shareholders in FY22, reflecting a trailing yield of 11.2% after a period of supernormal profits that were buoyed by elevated iron ore prices.

Rio Tinto (RIO) was the major disappointment as the miner lowered its payout ratio more than expected, resulting in a -11.6% miss on its interim dividend.

| DPS Mean | DPS Actual | Surprise % | FY Indicative Yield | |

| BHP | 3.24 | 3.25 | 0.30% | 11.20% |

| Commonwealth Bank | 3.8 | 3.85 | 1.40% | 4.00% |

| CSL | 2.07 | 2.22 | 7.20% | 1.10% |

| Woodside Energy | 1.02 | 1.09 | 6.90% | *NA |

| Wesfarmers | 1.69 | 1.8 | 6.30% | 3.80% |

| Telstra | 0.16 | 0.17 | 3.00% | 4.10% |

| Woolworths | 0.89 | 0.92 | 3.00% | 2.50% |

| Rio Tinto | 3.02 | 2.67 | -11.60% | *NA |

| Transurban | 0.4 | 0.41 | 1.80% | 3.00% |

| Fortescue Metals | 1.51 | 1.51 | -0.30% | 11.60% |

*December year end.

Source: Refinitiv, Wilsons.

Payout ratios have seemingly peaked and forward payout ratios are still falling during reporting season as an uncertain outlook makes investors wary of how much capital will be returned to shareholders.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.