Thematic investing is a forward-looking investment approach that seeks to capitalise on megatrends or strong short-term tailwinds.

We believe playing thematics creates another opportunity for outperformance. The key benefits of short-term thematics are typically:

- Significant growth tailwinds.

- Earnings upgrades as the market underappreciates growth.

- Reasonable valuations as the market underappreciated the opportunity.

In the Focus Portfolio, we are exposed to a few thematics at present, such as New Infrastructure: NXT, CWY, TLS, HCW; the Energy Transition: AKE, OZL, STO/WDS; and the one we will discuss in this note, the Global Reopening: QAN, TAH, ALL, and CSL.

The global reopening thematic is 17.5% of the Focus Portfolio.

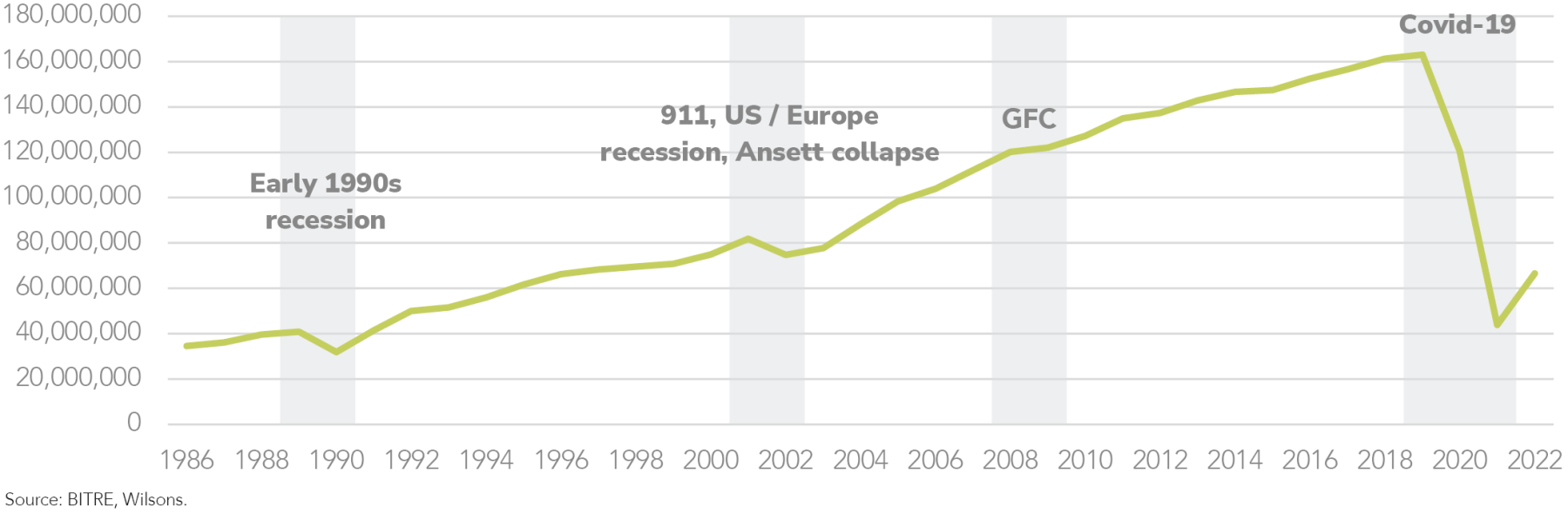

The World Is Still Reopening

Australians have moved on from lockdowns and border closures. However, life is still not “normal” post-COVID.

Even though the ASX 200 hit its COVID trough more than 2 years ago, many post-COVID recovery stocks have yet to reach their full potential. We think this creates a significant opportunity that is still not fully appreciated by the market.

Reopening stocks have discounted further in 2022 in response to the general market malaise.

Recovery outlook looks too slow

We think the current market forecasts for the travel recovery are still too conservative.

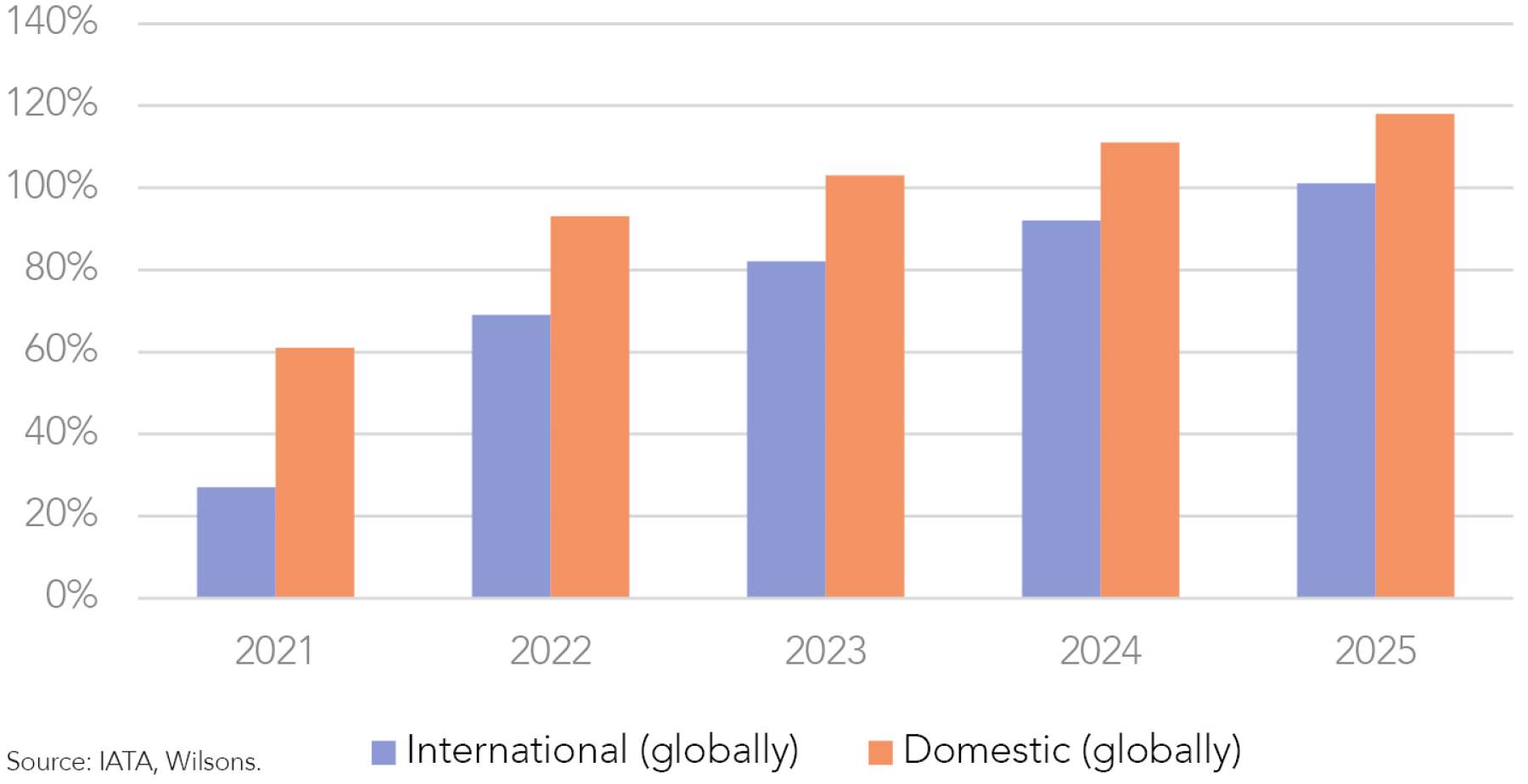

The International Air Transport Association (IATA) expects overall traveller numbers to reach 4.0bn in 2024 (counting multi-sector connecting trips as 1 passenger), exceeding pre-COVID-19 levels (103% of the 2019 total).

The IATA forecasts still suggest international travel will not recover to CY19 levels until CY25.

Considering that COVID restrictions are a thing of the past for most countries (especially Australia) and the level of pent-up demand for travel, we think travel will recover quicker than forecast.

Pent-up demand still to unwind

Pent-up demand for travel should lead to an acceleration in the recovery but also support higher pricing.

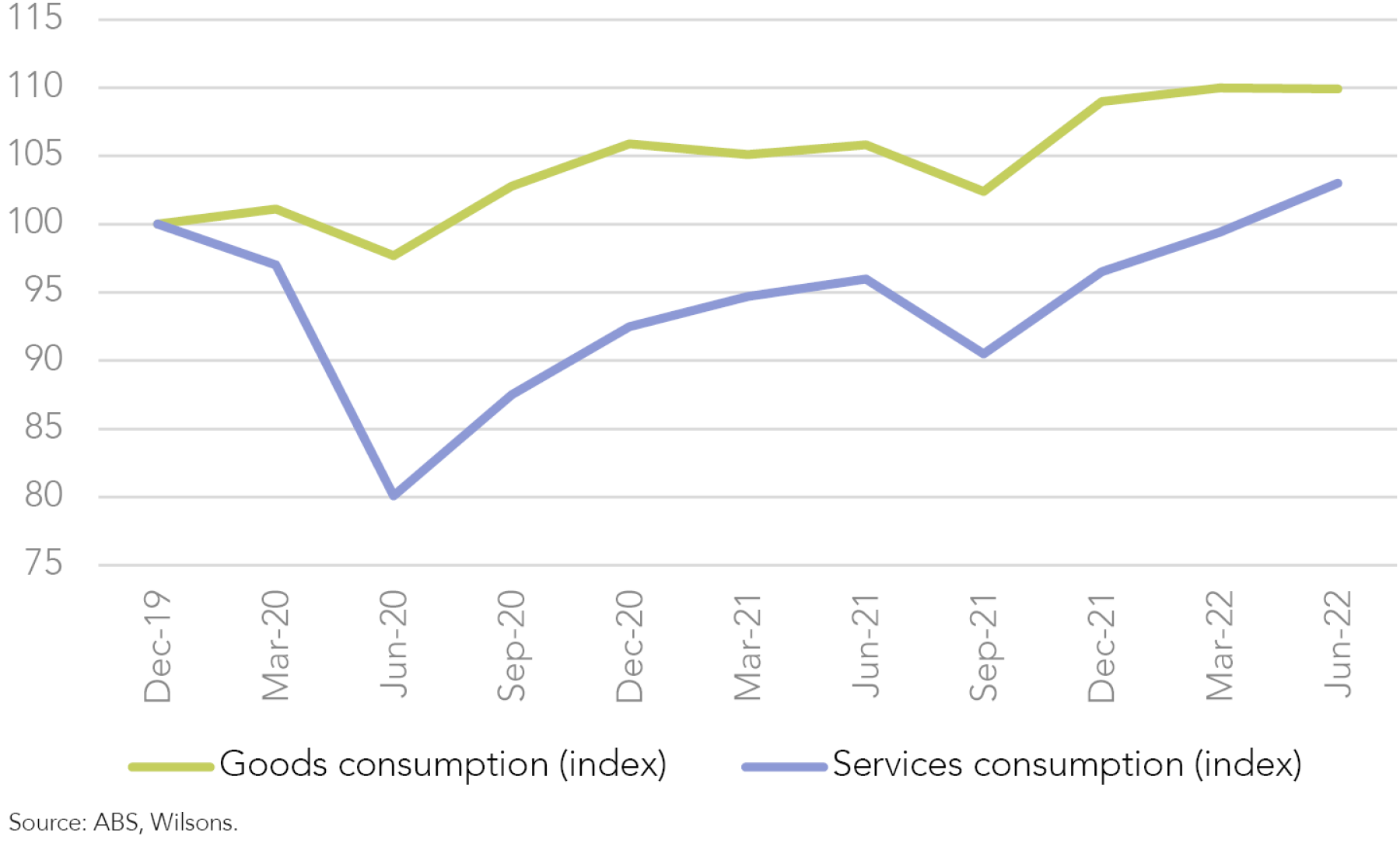

Following the lifting of restrictions and the success of vaccinations against Omicron, travel appears to be on the fast track to recovery. We believe that passenger numbers could go above 2019 levels as households rotate their spending away from goods and towards travel and other services.

We have seen an increase in airfares and hotel prices in the US as consumers look to scratch the travel itch over the past few months. We think prices and demand can remain elevated as consumers continue to spend disproportionally (relative to history) on services.

Reopening stocks yet to reach their full potential

Our earnings expectations for the next 12-24 months do not reflect the share prices of the stocks we are considering for the reopening trade. The share price of a company such as Qantas is still lower than it was in October 2021.

The fundamentals of these stocks have improved, so we believe they are at a good price point for investors.

Qantas (QAN) 4% – Reopening tailwinds with a chance for turbulence

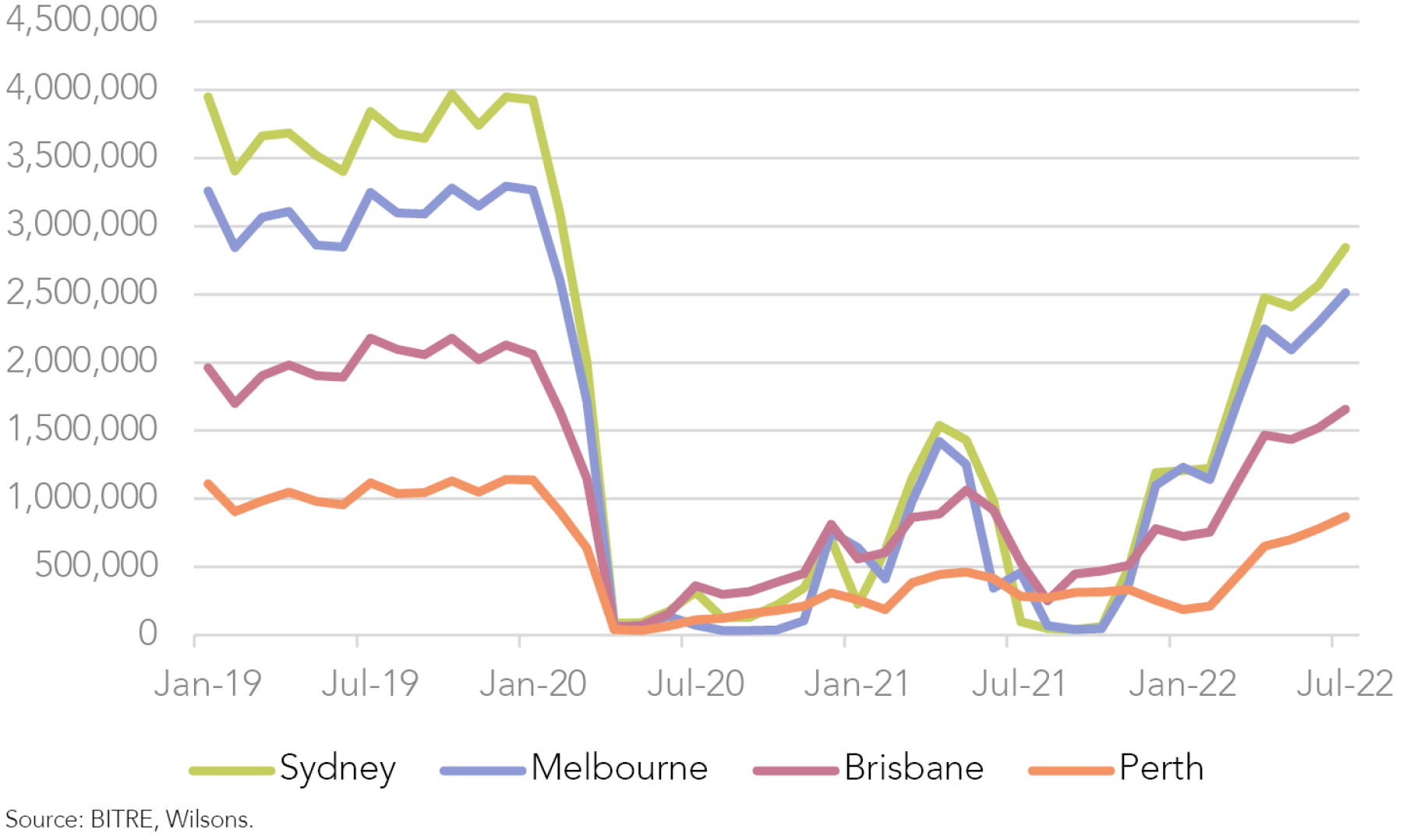

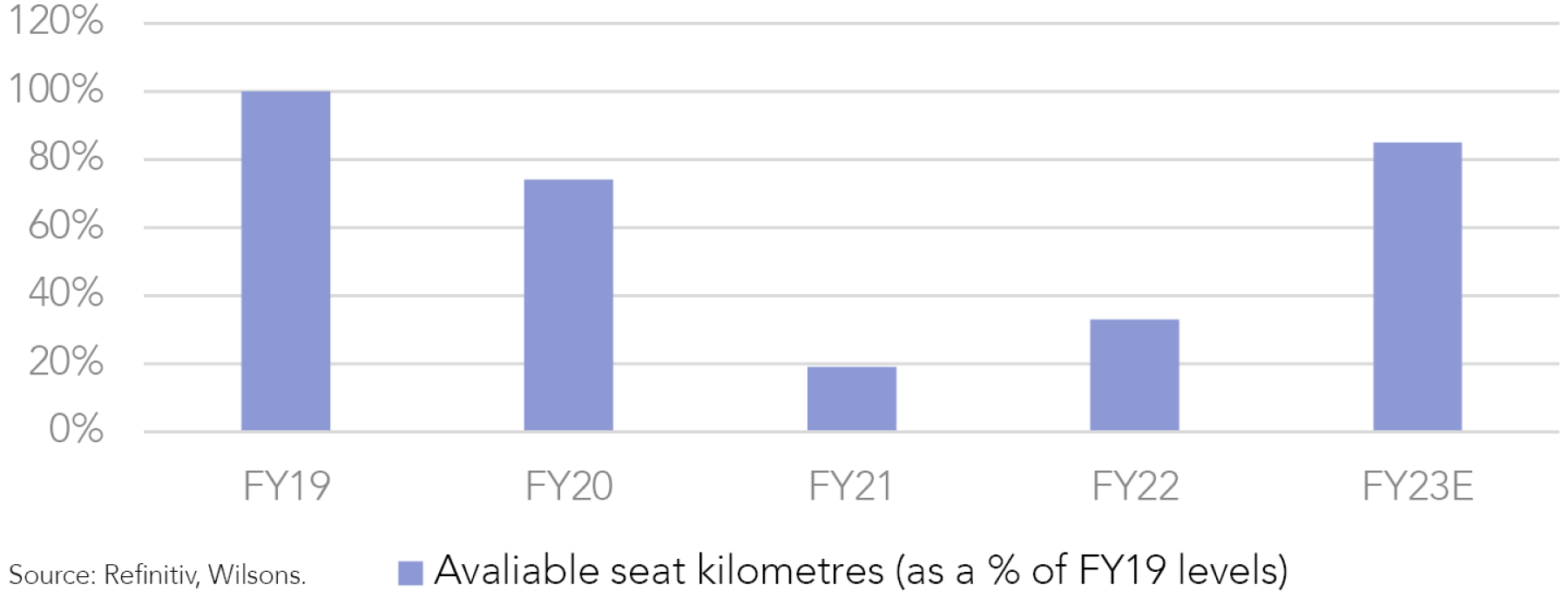

COVID-related lockdowns, border closures, and traveller hesitancy caused severe disruptions to flight volumes across the industry.

Operating conditions have started to normalise, although Australian domestic and international revenue passenger volumes still remain -12% and -45% below their pre-COVID PCP (July 2022).

Qantas is also emerging from COVID in a structurally stronger position with more resilient earnings than past cycles, given:

- Improved market position, with 68% domestic market share and 33% international market share, compared to 62% and 25% respectively, pre-COVID.

- A weaker domestic competitive environment with Virgin Australia going into voluntary administration and being acquired by private equity firm Bain Capital in 2020. In our view, the high likelihood of a Virgin IPO over the medium-term should create a supportive pricing environment in the domestic market, with Bain’s primary focus likely to be profitability not market share.

- More diversified earnings mix than in past cycles, with a much larger contribution coming from Loyalty and Jetstar, which are both more defensive than the core business.

- A structurally lower cost-base, supporting improved profitability. Qantas has delivered $920m of cost-outs to date, and is on track for $1bn by FY23 (this should offset higher oil prices).

- It has a stronger balance sheet. As of 30 June 2022, net debt was $3.9bn, down $2.0bn vs PCP, and below the current target range of $4.2bn-5.2bn. QAN's balance sheet capacity has underpinned its $400m share buyback, which we also view as a sign of confidence in the business.

We see upside from both an EPS and PE multiple perspective. Historically, QAN (and industry peers globally) have traded around 8-10x of earnings (EPS). Putting QAN’s FY24 consensus EPS on a 9x PE multiple, implies a fair value per share of $6.55. Plus, we see upside risk to EPS forecasts, and we believe QAN deserves a higher multiple than it has in the past, given it is now a more resilient business in a structurally stronger position.

Key risks include the potential for weaker discretionary expenditure as cost of living pressures intensify (i.e. cancelling holiday plans), and the threat of higher fuel costs squeezing airline margins. However, we believe that QAN will be reasonably resilient in a slowdown period.

| PE Multiple | FY24 Consensus EPS (-10%) | FY24 Consensus EPS | FY24 Consensus EPS (+10%) |

| 8x | 5.24 (1%) | 5.82 (12%) | 6.41 (23%) |

| 9x | 5.90 (13%) | 6.55 (26%) | 7.21 (39%) |

| 10x | 6.55 (26%) | 7.28 (40%) | 8.01 (54%) |

Source: Refinitiv, Wilsons.

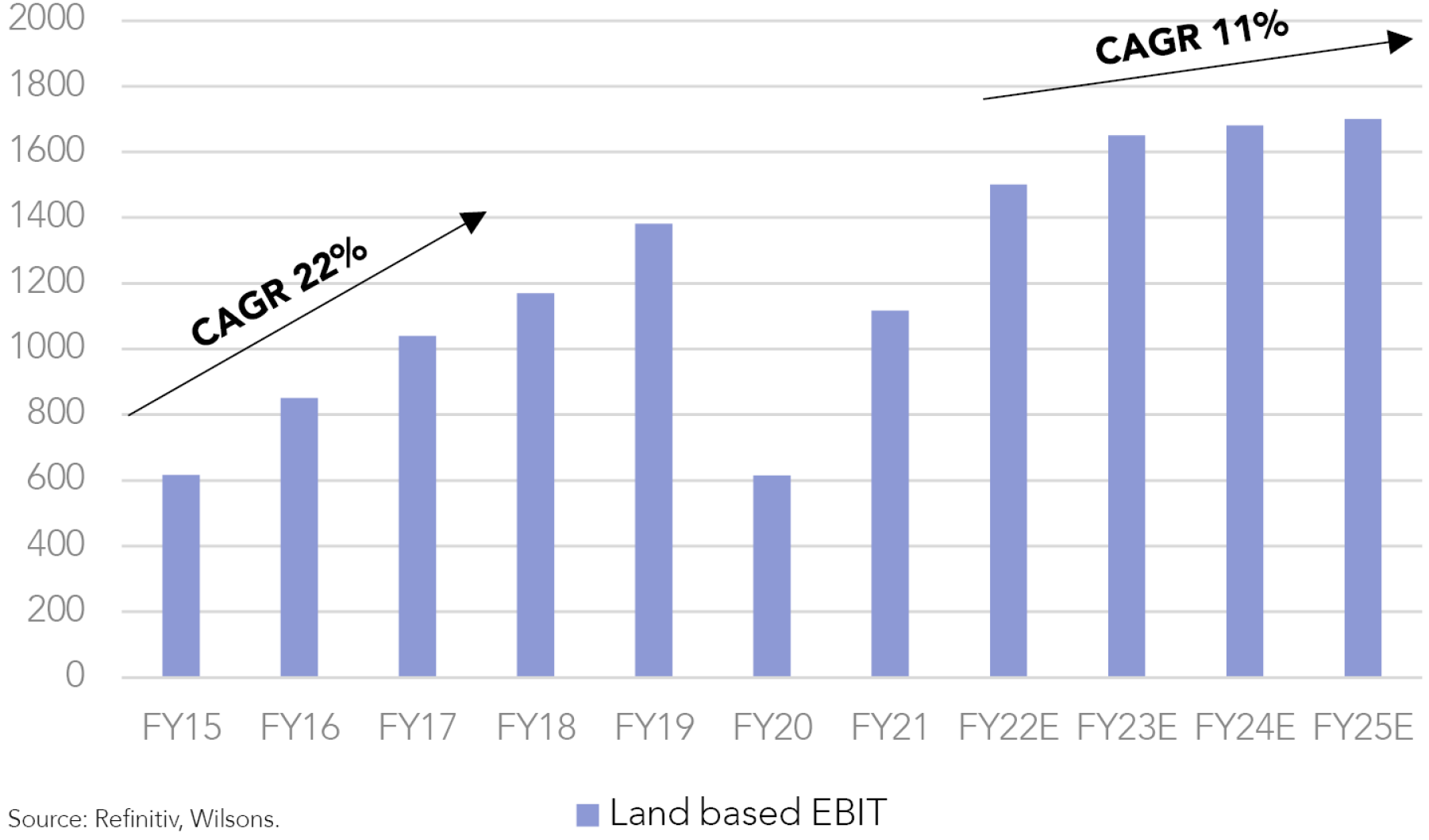

Aristocrat Leisure (ALL) 4% – Land-based gaming, the forgotten recovery story

Lockdowns and social distancing measures have materially disrupted Aristocrat’s land-based business, which both sells and leases electronic gaming machines (EGMs) to casinos and other venues, partially offset by strong growth across its digital product suite.

We think current medium-term consensus estimates for ALL’s land-based earnings are too conservative relative to the historical pre-COVID trend, particularly given recent positive industry trends (US slot gross gaming revenue is 20% higher than pre-COVID levels) and the market share gains the business has achieved. We expect land-based EGMs to remain a significant part of the gaming industry for many years to come. Therefore, we expect earnings upgrades in the land-based business in the coming periods.

We still expect digital to be the key structural growth driver for Aristocrat over the medium to long-term, as the business keeps increasing share in both its existing mobile games portfolio while also expanding into new verticals.

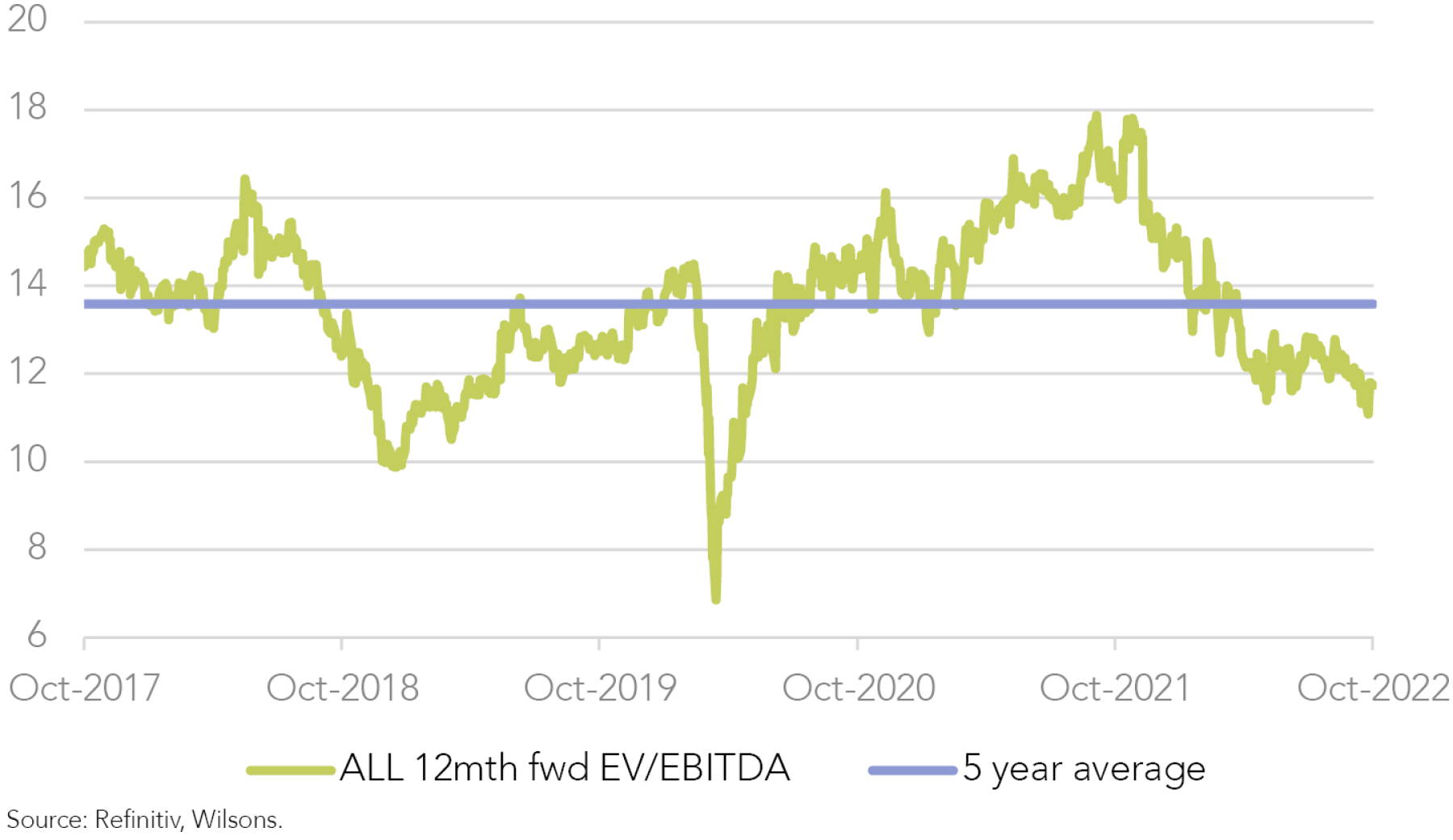

In terms of valuation, ALL trades at a forward EV/EBITDA multiple of 11.8x, which is 1 standard deviation below its 5-year average. This is attractive relative to consensus estimates of ~9% EBITDA growth to FY24 (where we see upside risk). We think ALL deserves to trade at a premium multiple given its dominant market position and the significant runway for growth in digital over the long-term.

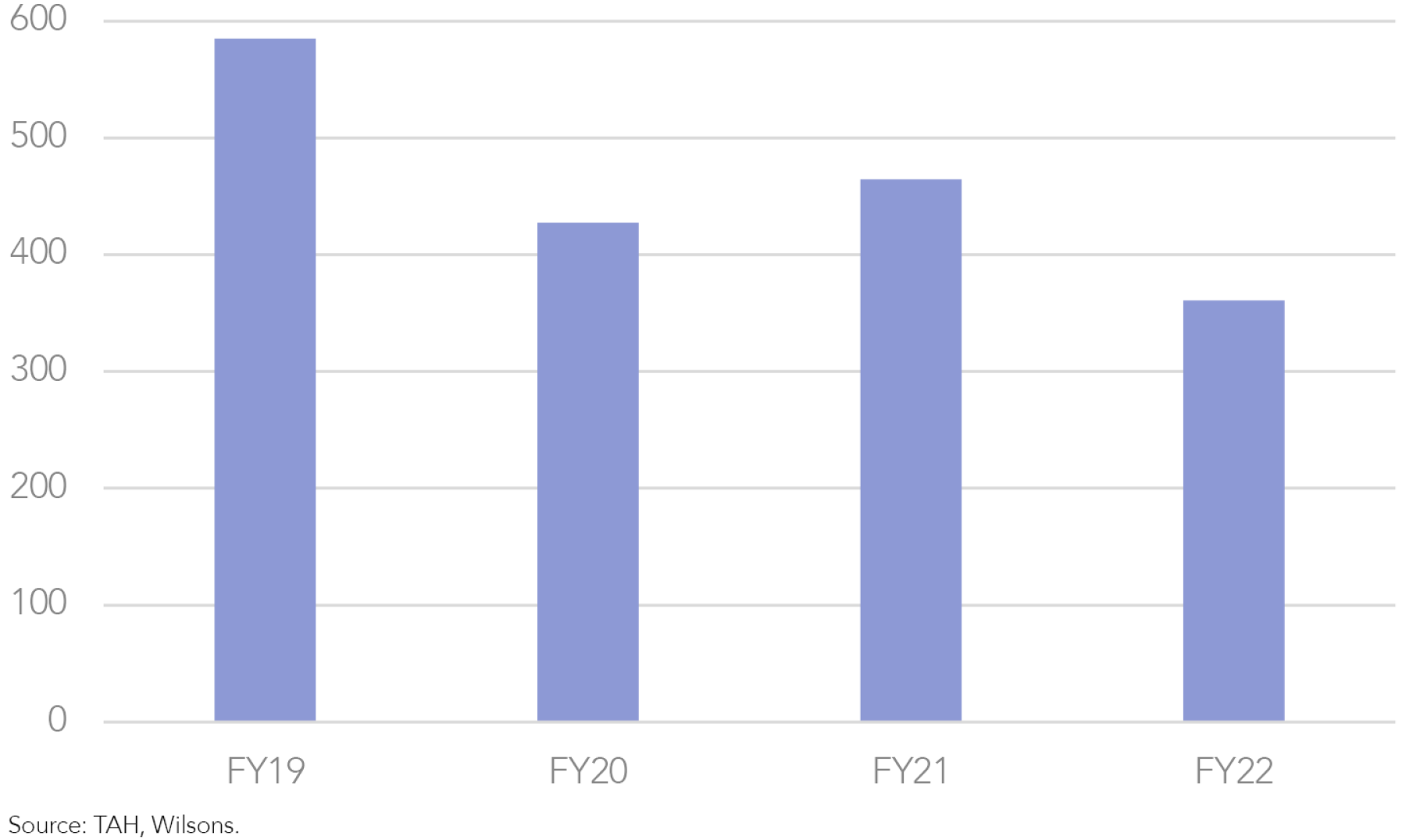

Tabcorp (TAH) 1% – Retail channel, a clear FY23

Mandated venue closures and social distancing requirements impacted TAB’s retail (on-premise) wagering operations as well as its gaming services division, which services EGMs.

Currently, ~35% of TAH’s wagering turnover is still through the retail channel, while ~65% is digital. Therefore, as the only licensed retail bookmaker in most Australian states (excluding Western Australia), TAH was most severely impacted by lockdowns compared to digital-only bookmarkers. FY22 retail turnover was still down 45% vs FY19.

As COVID-related restrictions on venues, as well as racing/sports, have now eased, we anticipate a strong earnings recovery in FY23 as operating conditions return to normal.

We see upside risk to consensus earnings forecasts given:

- The potential for stronger-than-expected patronage at licensed venues post-lockdown.

- Regulatory reforms which could level the playing field on wagering fees/taxes.

- Structural cost-base reforms – target of 3-4% cost growth in FY23.

- Potential upside in the digital supported by the new TAB app, new features etc.

Previous M&A interest in TAH points to significant valuation upside for TAH. Apollo’s $4bn bid for the TAH business in its current form (i.e. excluding lotteries) in 2021 translates to an implied value of $1.80 per share.

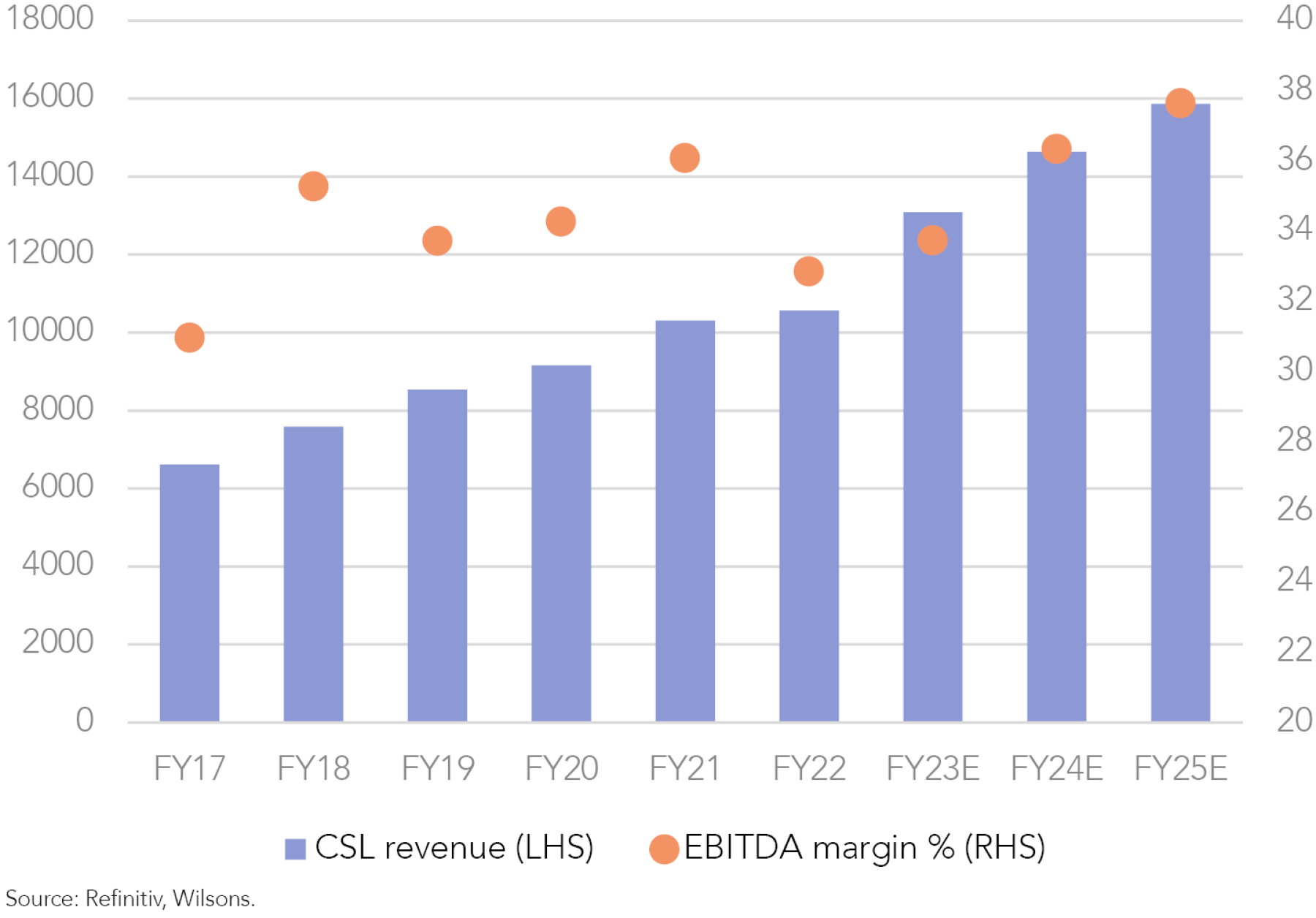

CSL (CSL) 8.5% – Plasma collections regaining momentum

The core business (CSL Behring) collects plasma from donors, primarily in the US, to make treatments for immune efficiency and neurological disorders.

COVID caused a lot of problems with collections as donors feared infection and were cashed up after bumper stimulus cheques.

As stimulus has been withdrawn and with cost of living pressures increasing more donors are coming to donation centres, and collection volumes are ramping back up again. We have already seen an improvement in plasma collected in 2H22.

CSL were paying donors more for plasma in the US during the COVID to incentivise collections. However, as supply issues fade, CSL can collect more plasma at a lower cost.

This is a volume story but also a margin improvement story. This is coupled with new technological advances in collection centre capacity, which should drive more plasma per donor—leading to even better margin outcomes.

Written by

Rob Crookston, Equity Strategist

Rob is an experienced research analyst with a background in both equity strategy and macroeconomics. He has a strong knowledge of equity strategy, asset allocation, and financial and econometric modelling.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.